Raising the US public debt ceiling is the topic of fundamental concern at the moment with the June 1 deadline, highlighted by Treasury Secretary Janet Yellen, approaching. What impact to consider on Bitcoin (BTC)?

A deal to raise the US public debt ceiling would be good for Bitcoin

Remember that in the United States, there are a legal ceiling on public debt which shall not be exceeded and which is determined by the United States Congress, the United States House of Representatives and the United States Senate. This public debt represents the sum of the budget deficits of the American Federal State and it is necessary for the proper functioning of the American Administration as well as its multiple economic and administrative services.

The current issue is that a negotiation – necessary – is underway between the Democratic Administration of President Joe Biden and Speaker Kevin MacCarthy, the Republican leader of the American Representatives and the lower house of the American Parliament.

Without agreement between the 2 parties by the end of the month, the US federal government will then be in a shutdown situation and this will cause damage to the US economy due to the suspension of economic interactions between businesses and consumers on the one hand, and state services on the other hand.

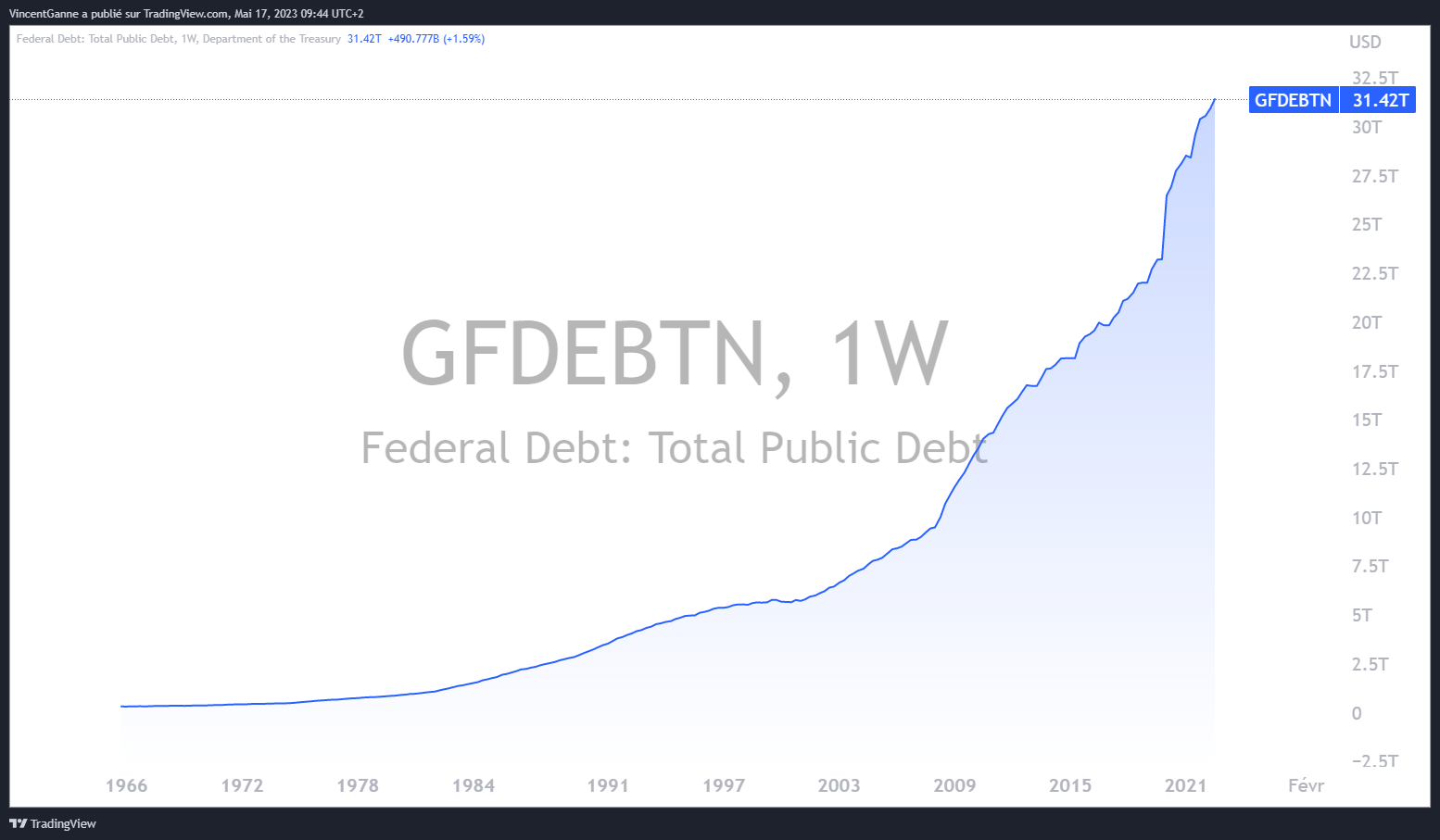

In the past, there have already been shutdown episodes, 6 shutdown periods to be precise, 2 of which lasted more than 2 weeks between 1995 and 2013. Since then, the general level of US public debt has exploded upwardsa new period of shutdown would put the solvency of the federal state at risk, whose simple debt service (payment of interest on the current debt) requires new budget deficits.

After doing some research, it turns out that the economic and stock market impact of these past shutdowns has been limited.but in the current fundamental context of fighting inflation, the consequences could be more serious.

In any case, if the shutdown is avoided thanks to a bipartisan agreement, then it will have a bullish effect on the American stock market, and by correlation, bullish on the price of Bitcoin.. This is therefore the burning fundamental theme for the very next trading sessions.

Chart that shows the evolution of the amount of public debt in the United States

Chart that shows the evolution of the amount of public debt in the United States

👉 Discover our guide to buy Bitcoin (BTC) simply

Buy crypto on eToro

2 chart patterns are possible in the short term for BTC

The next evolution of this issue of the American debt ceiling will allow the price of Bitcoin to finally make a chartist choice. I believe that this choice must be made between 2 hypotheses:

- Exceed the resistance at 28,000 dollars and resume the upward path towards 32,000 then 35,000 dollars, this last level being the major resistance for the medium/long term;

- Retrace in the direction of 24,000 / 25,000 dollars, to take liquidity before starting to attack the resistances mentioned.

These 2 technical working hypotheses would be invalidated in case of support breakout at $23,000 with then a risk of filling the bullish gap below 21,200 dollars on the BTC future contract. Now let the market make its choice in soul and conscience.

Chart that displays the price of the bitcoin futures contract in daily Japanese candles

Chart that displays the price of the bitcoin futures contract in daily Japanese candles

👉 Find exclusive and daily analyzes of Vincent Ganne on Cryptoast Research

Take your investments to the next level with the analyzes of Vincent Ganne

Source: Trading View

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.

;Resize=(1200,627)&impolicy=perceptual&quality=mediumHigh&hash=b373430d2353490c8f4a0f4bbfa7bae64b1cb82cbc8cf2008e11d61a16833466)