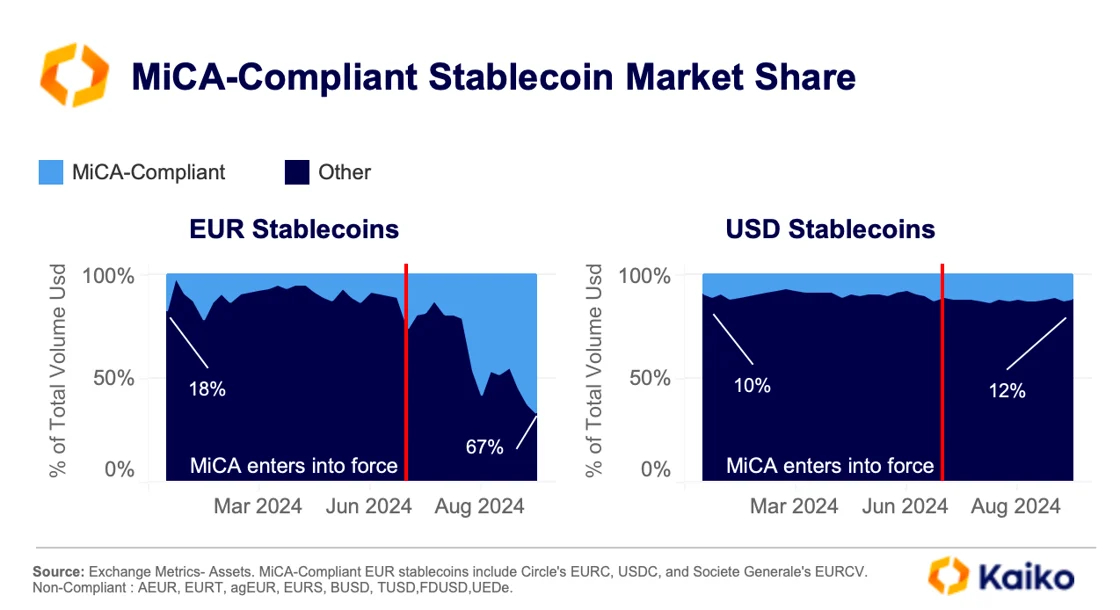

Three months after the entry into force of the MiCA component on stablecoins, 67% of those following the euro rate are compliant with the new rules. We take stock.

Kaiko studies the impact of MiCA on stablecoins

On June 30, the stablecoin component of the MiCA regulation entered into partial application within the European Union. Initially, issuers of this asset class must comply with new rules, while crypto exchanges still have a few months to prepare before January 1, when MiCA comes into full application. .

It was from there that Kaiko carried out a study on the subject. It thus appears in the results that this regulatory novelty has had a marked impact on the euro stablecoin landscapebut much less when it comes to their dollar-backed competitors.

From now on, 67% of the capitalization of euro stablecoins complies with the directives imposed by MiCA, compared to 18% last spring. For comparison, the difference is only 2% for the dollar during the same period:

Evolution of the share of stablecoins compliant with the MiCa regulation

Coinbase: register on the most famous crypto exchange in the world

Among these euro stablecoins, we can of course cite EURC from Circle, as well as EURCV from Société Générale — Forge. However, Kaiko observes that weekly trading volumes on this category of stablecoins have decreased significantly since the spring:

Overall, weekly trading volumes of euro-backed stablecoins have remained relatively stable at around $30 million since the implementation of MiCA, which is significantly lower than the $100 million level seen in March. This indicates that there has not been a significant increase in demand for euro-backed stablecoins despite the regulatory changes.

Conversely, the change in distribution within market shares could be explained by the actions of centralized platforms, which will in turn have to comply soon. However, this does not concern not decentralized exchanges (DEX)which, on the dollar side, could for example allow USDT to maintain its lead over its main competitor, Circle's USDC.

Open an account on N26, the crypto-friendly bank

Source: Kaiko

The #1 Crypto Newsletter

Receive a summary of crypto news every day by email

What you need to know about affiliate links. This page may feature assets, products or services relating to investments. Some links in this article may be affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no harm to you and you can even get a bonus using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and cannot be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your capacity to lose part of this savings. Do not invest if you are not prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.