While the FTX affair has undermined investor confidence, many rumors are emerging regarding the exchanges. This is particularly the case with Gate.io’s Proof of Reserve, which is the subject of doubts after the Crypto.com error.

Gate.io Proof of Reserve Fraud Rumors

From the explosion in full flight of FTX, the notion of ” Proof of Reservehas attracted the spotlight, and with it, many rumors about potential falsifications of certain platforms.

If the concept of applying a policy of transparency towards its community was already beginning to develop, it is now the subject of very special attention and more and more exchanges are playing the game .

But another event cast doubt on the very concept of proof of reserve: the 320,000 ETH mistakenly sent by Crypto.com to Gate.io.

While this transaction is hardly conceivable, the date on which Gate.io’s audit was rendered did not fail to feed the rumors that Crypto.com participated in defraud the Proof of Reserveof the platform. And for good reason, while the error at 320,000 ETH was made on October 21, Gate.io’s audit was returned on October 28.

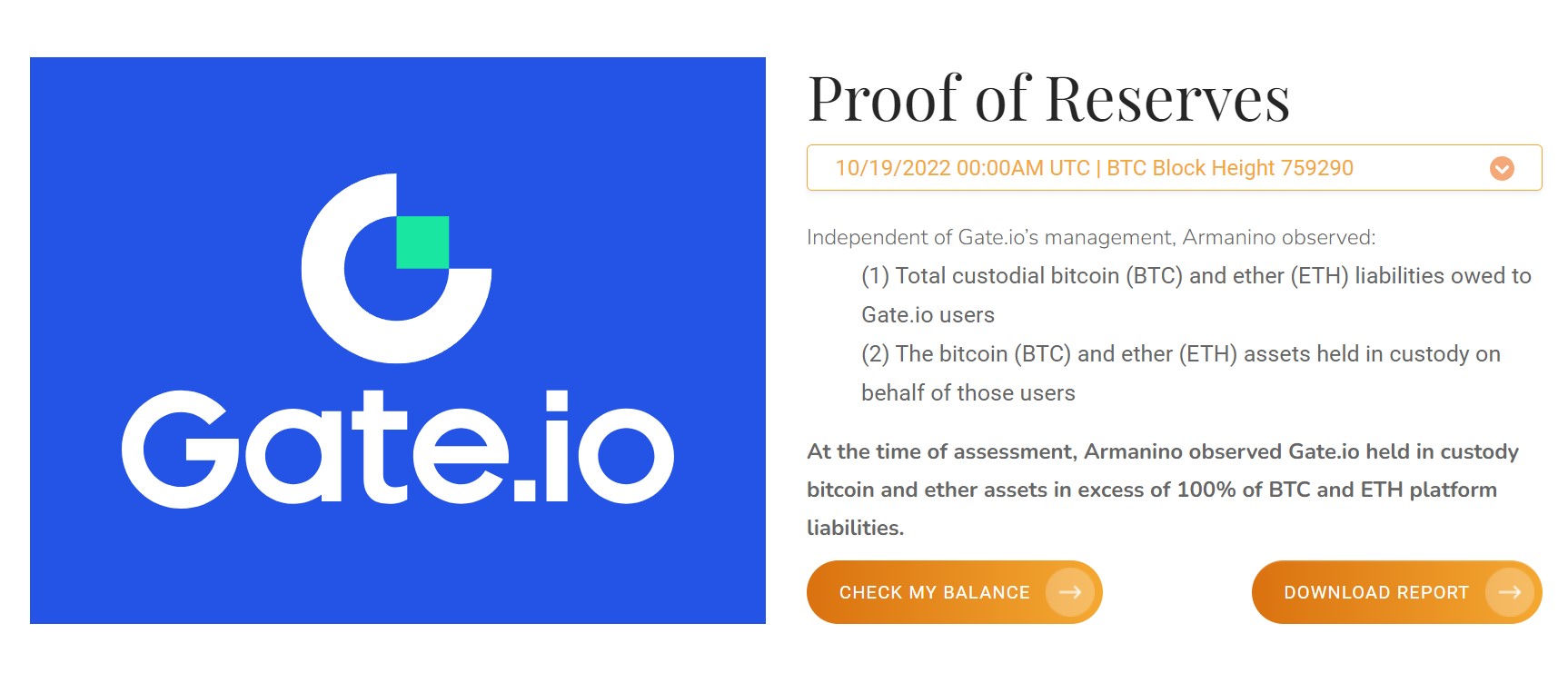

Yet, while October 28 is indeed the date Armanino performed the audit issuance, the company verily attests to the state of Gate.io’s funds. as of October 19invalidating the Proof of Reserve fraud argument.

Proof of Reserve from Gate.io as of October 19

Thus, although the Crypto.com transaction is subject to many questions, it is not a question of engaging in hasty conclusionsfueled by the anxiety-provoking context of the moment.

👉 Follow the FTX deal in real time

Alyra, training to integrate the blockchain ecosystem ⛓️

Stay alert without falling into FUD

If it is important for us to give our readers the tools to prevent them from falling into the “fear uncertainty and doubt(FUD), neither can we, conversely, assert that centralized platforms are risk-free.

Recent events have once again demonstrated that everything could change very quickly, and it is essential to be wary of third parties assumed to be trusted.

Given the general mood, Twitter is full of caveats more or less based on various platforms in the ecosystem, the reservations of which could pose a problem. However, on-chain analysis is a discipline requiring real expertise and it can be difficult to sortbetween serious investigations and sometimes baseless rumours.

Thus, it will be appropriate for everyone to dig into the subjects that concern them in order toform their own opinion based on their own risk policy and to withdraw its funds from the various protocols and platforms of the ecosystem in the event of doubts about the integrity of the service.

👉 Also in the News – $71 Billion in Cryptocurrencies – Binance’s Crazy Reserves

Join Experts and a Premium Community

PRO

Invest in your crypto knowledge for the next bullrun

Source: Armanino

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky.Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.