Katharine Wooller, Business Unit Director at Coincover Thinks the FCA is taking an encouraging step. She feels that the UK’s approach to regulation has been sluggish, so she thinks more proactivity to protect users is a positive step.

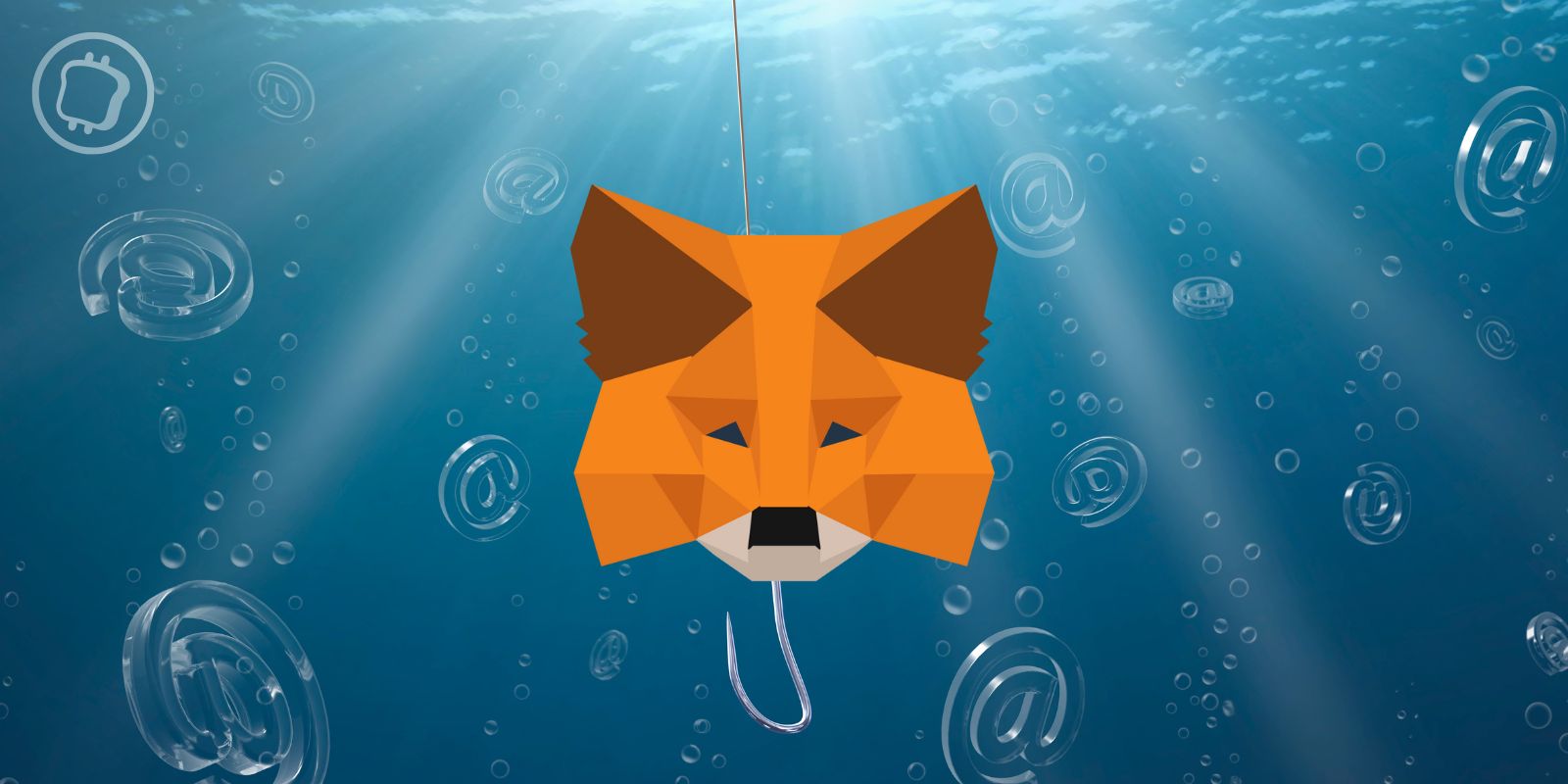

“Trust in cryptocurrencies has collapsed once again following the FTX scandal. And if it’s not the collapse of trusted crypto brands, theft, hacking and fraud continue to drive consumer anxieties and skepticism of the entire market. The unfortunate reality is that digital assets remain vulnerable to abuse from a small pool of bad actors, which is why we need to introduce safeguards and proper governance standards.

Without regulation, the market will continue to be a Wild West with abnormally high level of risk. But if implemented correctly, regulation can reduce those risks and protect investors. At the same time, this will also prevent the failures and corruption that create wider market turbulence and ultimately provide cryptos with the trust and security needed for growth.”

The FCA has regularly been in the news, because of its very conservative and extremely strict stance on the approval of crypto businesses. Despite the plans to turn the UK into a bustling crypto hub.

A little less than a year ago Chancellor of the Exchequer, Rishi Sunak said:

”It’s my ambition to make the UK a global hub for cryptoasset technology, and the measures we’ve outlined today will help to ensure firms can invest, innovate and scale up in this country.”

So far the FCA, also called the United Kingdom’s financial watchdog, has given the all-clear to only 41 out of 300 crypto firm applications seeking regulatory approval to date.