AXA Investment Managers, the subsidiary of the AXA group specializing in investment management, has just registered as a digital asset service provider (PSAN). We asked Faustine Fleuret, the president of Adan, what the arrival of such a behemoth augurs for the ecosystem of PSANs and more broadly for the cryptocurrency market.

AXA wants to offer cryptocurrency services

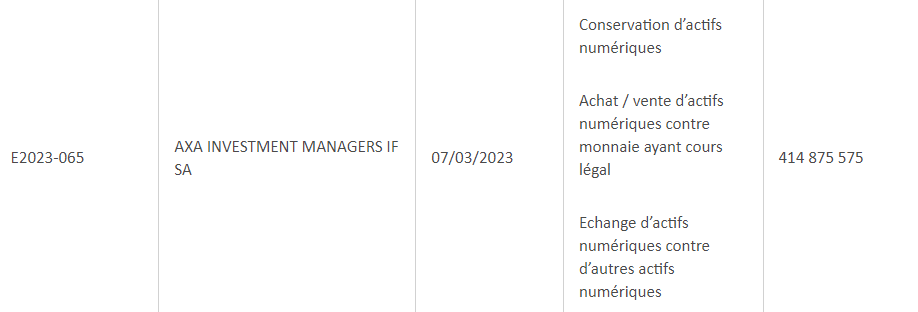

On March 7, the Axa subsidiary specializing in investment management, Axa Investment Managers, has been registered as a Digital Asset Service Provider (PSAN).

With this recording issued by the Financial Markets Authority (AMF), Ax Investment Managers will be able to offer services for the custody, purchase, sale, but also exchange of digital assets.

Registration of AXA Investment Managers on the AMF website

However, the AXA group’s interest in cryptocurrencies and the blockchain sector is not new: in April 2021, its subsidiary AXA Switzerland announced that it was accepting Bitcoin (BTC) as a means of payment for its services. insurance as part of a partnership with Bitcoin Suisse. A manager of the subsidiary then mentioned “ growing customer demand for this type of alternative payment.

In the same vein, in February 2022, AXA France had offered itself a plot in the metaverse of The Sandbox (SAND), justifying this audacious initiative by its ” responsibility to take part in major technological advances to imagine the insurance of the future “.

👉 What is PSAN status and how do you get it?

Trade stocks or cryptos

A €20 action offered when you register 💰

What does the arrival of such a giant in the PSAN ecosystem mean?

The arrival of Axa in the sector is not insignificant: the French group, which operates internationally, generates tens of billions of euros in turnover each year. Its subsidiary AXA Investment Managers is not to be outdone, also evolving throughout the world. The latter effectively holds more than 827 billion euros in assets under managementfunds from both institutional and retail clients.

To fully understand the interest of such a company in registering as a PSAN, we asked a few questions to Faustine Fleuret, president of the Association for the Development of Digital Assets in France (Adan).

The Axa group has just confirmed its interest in the digital asset sector, with its subsidiary Axa Investment Managers having just received registration as a digital asset service provider (PSAN). How do you perceive the arrival of such a giant in the industry, which also holds more than 820 billion dollars in assets under management?

Faustine Fleuret : Adan very positively welcomes the registration of AXA IM as a PSAN, which reflects a new sign of institutionalization of the sector and which shows that a growing number of players who do not necessarily come from the crypto ecosystem nevertheless perceive the potential of this innovation. As such, they can appropriate it for their own purposes, but also develop it and take advantage of it to create new activities.

The highlight of this announcement is above all AXA’s membership of the CAC40, which directly echoes the registration of Forge, the subsidiary of Société Générale, which had also registered as a PSAN. last September. The arrival of players of this size directly brings credibility to the category of crypto-assets and the use cases they allow. As the field of crypto-assets remains a sensitive subject, the arrival of such companies helps to shake things up and encourage other large companies to follow suit.

It should also be noted that the registration of AXA IM makes it possible to strengthen the still timid links established between traditional finance and players in the crypto sector. Indeed, these links directly constitute a vector of adoption, since if we take the case of AXA IM, we can imagine that many of its customers are not necessarily familiar with crypto-assets. Therefore, the registration we are talking about here could allow the latter to open up to it.

Finally, with the adoption of crypto-assets by institutionals, we can also imagine that the obstacles that usually arise for companies wishing to register as a PSAN could be more easily removed.

We know that PSAN approval (which no company has yet managed to obtain) requires companies wishing to obtain it, among other things, to take out professional liability insurance (RC pro). As the Axa group is above all specialized in insurance, would it try to take the lead in this regard? It could thus offer to insure the funds of other PSANs, or, in another case, to insure its own subsidiary and thus create a monopoly by obtaining approval.

FF : Although we are not in the secret of AXA, the fact is that, factually, the subsidiary of AXA will have to be authorized to offer its services under the MiCA regime, an essential step for those who wish to operate within the European Economic Area once the latter comes into force. PSANs today face certain prudential requirements requiring them to obtain professional liability insurance to cover their activities.

We know that these are products that remain extremely rare today and which are therefore complicated to obtain for NHPs. Very few insurers today offer to cover PSANs for this purpose, and the few that do so still do so at extremely prohibitive rates, which constitutes a significant barrier to entry for new entrants. who are sometimes just starting their business. A lack of offers which is also justified by a certain misunderstanding of the sector and its inherent risks.

Regarding AXA IM, the company inevitably having to insure itself in the future, it is quite possible that it will offer insurance services dedicated to the sector when the time comes since it will use it itself by force things. Despite everything, it is also possible that AXA wishes to be self-sufficient in terms of insurance without offering this type of coverage to other PSANs, but this is still difficult to determine.

Anyway, the registration of AXAI IM as a PSAN is good news for the sector and constitutes a proof of credibility for the whole cryptocurrency market, and which could help, why not, to raise the obstacles facing the PSANs today.

👉 Read also – According to Paxos, 89% of cryptocurrency investors place their trust in banks and exchanges

🎁 Cryptoast Research Launch Offer

1st Newsletter Free with the code TOASTNL

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky in nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.