The IRS has filed 45 compensation claims against FTX and its subsidiaries totaling $44 billion. These requests were categorized as “Admin priority,” giving the IRS priority over other creditors, including FTX’s aggrieved customers. The sums requested relate mainly to corporation tax, income tax and social charges.

US Treasury meddling with FTX

Here is an announcement that is likely to cause a lot of ink to flow: the Internal Revenue Service (IRS)the agency responsible for collecting income tax and certain taxes in the United States, filed 45 claims against FTX and its affiliates for a staggering $44 billion.

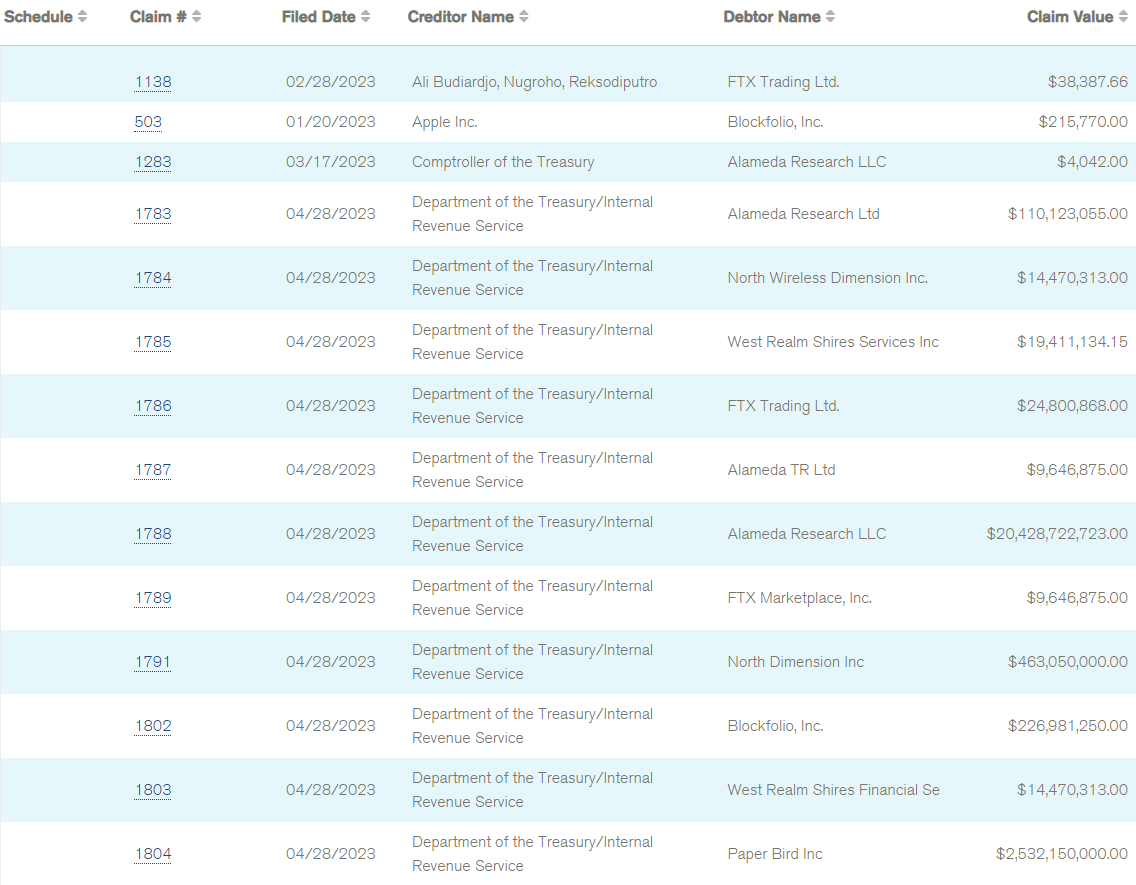

The requests were all filed between April 27 and 28, and target various companies formerly under the Sam Bankman-Fried umbrella such as Blockfolio, North Wireless Dimension, Weast Realm Shires Services, FTX Trading, FTX Marketplace and certain branches from FTX.US, among others.

Each company thus received a claim for compensation of a highly variable amount. Alameda Research, formerly run by Sam Bankman-Fried’s ex-girlfriend, Caroline Ellison, was handed the biggest penalty, however. namely more than 37.8 billion dollars alone.

This sum was divided between 2 branches of the firm, Alameda Research LCC and Alameda Research Holdings Inc.

Overview of claims regarding FTX and its affiliates

Overall, the requests from the IRS mainly concern sums relating to corporation tax, then income tax and certain social charges.

👉 Safely browse the Web3 with ZenGo Wallet

Discover ZenGo

$10 Bitcoin bonus from $200 deposit 🔥

Government before customers?

A small detail written on the requests is however of major importance: these have been filed under the “Admin priority” classification. This means that IRS requests, since they are administrative in nature, enjoy full priority over other creditors, i.e. aggrieved customers of the exchange who lost money as a result of its bankruptcy.

However, the methodology used here by the IRS raises questions, as some professionals in the sector have questioned the amounts requested by the federal agency. Moreover, as pointed out by some observers on Twitter, FTX’s Restructuring Team Should Naturally Defend Against IRS Claims.

The claim circulating CT is real and a few things to note:

1) Tax man does get paid 1st in a BK which is why it is filed under an Admin Priority status2) FTX estate will defend against this claim

3) Calculation of their claim was not publicly filed but few things jump out:… https://t.co/psDGseeWgi

— Mr. Purple 🛡️ (@MrPurple_DJ) May 10, 2023

Moreover, the amounts requested by the IRS from companies that are bankrupt or in difficulty are very often revised downwardsas may have been the case for Lehman Brothers, which was initially asked for 1.2 billion dollars, only to see this sum lowered to “only” 370 million dollars.

Be that as it may, the amount of sums here requested by the IRS seems disproportionate, and the current FTX team is already struggling to raise the $11 billion needed to reimburse customers. It remains to be seen what FTX’s legal team will do to defend itself in this new case, which seriously complicates the already heavy case of what was once the second largest exchange in the world behind Binance.

👉 In The News – Binance launches “Capital Connect”, its platform to connect VIPs with crypto fund managers

Buy crypto on eToro

Source: Kroll

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This page presents assets, products or services relating to investments. Some links in this article are affiliated. This means that if you buy a product or register on a site from this article, our partner pays us a commission. This allows us to continue to offer you original and useful content. There is no impact on you and you can even get a bonus by using our links.

Investments in cryptocurrencies are risky. Cryptoast is not responsible for the quality of the products or services presented on this page and could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a good or service highlighted in this article. Investments related to crypto-assets are risky by nature, readers should do their own research before taking any action and only invest within the limits of their financial capabilities. This article does not constitute investment advice.

AMF recommendations. There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notices pages.